Task 3: Would a stock broker lie to you?

In this third task we will explore what short selling is.

Okay lets start by reading the following extracts

Perhaps the largest case of buyer’s denial, at least in terms of alleged damages, is in the fraud involving a tiny company known as CMKM Diamonds, which purported to have valuable diamond mining claims. In reality, what it had was a publicity machine, including the sponsorship of a car at 'funny car' races around the country. Several shareholders in CMKM some of whom kept buying shares after the government exposed the fraud want 10 current and former commissioners of the Securities and Exchange Commission to pay them $3.87 trillion, an amount equal to about half the United States government debt in public hands. You might think that would be enough, but the suit claims those are merely compensatory damages. They also want punitive damages, but do not cite a figure. That is an impressive amount for a company whose last published balance sheet showed total assets of $344. That is dollars, not millions...

See the full article here:

http://www.nytimes.com/2010/03/12/business/12norris.html

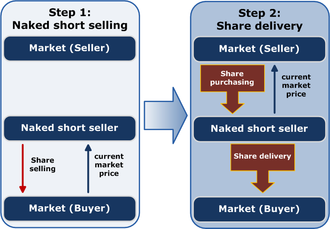

..."Essentially, you're selling something you don't own," explains David Musto, a professor of finance at the University of Pennsylvania's Wharton School. It sounds impossible, he said, but here's how it works: When a traditional short seller thinks, say, a bond is in trouble he will set out to borrow the bond, sell it to a buyer at its current market value, and then buy it back after its price falls. He can then pocket the difference and return the security to the bond's original holder, who he borrowed it from in the first place. But in a "naked" short sale, the short seller makes the deal without ever having access to the securities to begin with. Perhaps he doesn't know anyone he can borrow it from, Musto said. Or he originally had access to a lender, but then some event in the marketplace altered his ability to borrow and deliver the goods. Until the short-seller has bonds to deliver, the buyer doesn't have to pay. But by showing that a sale has taken place even though the goods haven't actually been transferred, a naked short-sale artificially drives a stock's price down to a level that's not reflective of true supply and demand, said Sharyn O'Halloran, professor of political economy at Columbia University...

See the full article here:

http://money.cnn.com/2010/05/19/news/economy/naked_short_selling_wtf/index.htm

Let us quickly recap.

Naked short selling is when a broker sells 'troubled' shares, which they don't own, with intention of buying them back when the price drops.

It is in the brokers interest to sell a share which they know will lose value (charming!).

You should collaborate and clarify these concepts in the comment section below.

Okay lets start by reading the following extracts

Perhaps the largest case of buyer’s denial, at least in terms of alleged damages, is in the fraud involving a tiny company known as CMKM Diamonds, which purported to have valuable diamond mining claims. In reality, what it had was a publicity machine, including the sponsorship of a car at 'funny car' races around the country. Several shareholders in CMKM some of whom kept buying shares after the government exposed the fraud want 10 current and former commissioners of the Securities and Exchange Commission to pay them $3.87 trillion, an amount equal to about half the United States government debt in public hands. You might think that would be enough, but the suit claims those are merely compensatory damages. They also want punitive damages, but do not cite a figure. That is an impressive amount for a company whose last published balance sheet showed total assets of $344. That is dollars, not millions...

See the full article here:

http://www.nytimes.com/2010/03/12/business/12norris.html

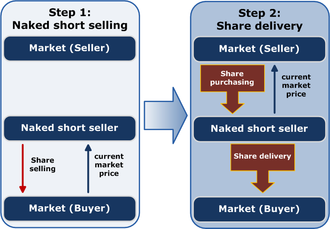

..."Essentially, you're selling something you don't own," explains David Musto, a professor of finance at the University of Pennsylvania's Wharton School. It sounds impossible, he said, but here's how it works: When a traditional short seller thinks, say, a bond is in trouble he will set out to borrow the bond, sell it to a buyer at its current market value, and then buy it back after its price falls. He can then pocket the difference and return the security to the bond's original holder, who he borrowed it from in the first place. But in a "naked" short sale, the short seller makes the deal without ever having access to the securities to begin with. Perhaps he doesn't know anyone he can borrow it from, Musto said. Or he originally had access to a lender, but then some event in the marketplace altered his ability to borrow and deliver the goods. Until the short-seller has bonds to deliver, the buyer doesn't have to pay. But by showing that a sale has taken place even though the goods haven't actually been transferred, a naked short-sale artificially drives a stock's price down to a level that's not reflective of true supply and demand, said Sharyn O'Halloran, professor of political economy at Columbia University...

See the full article here:

http://money.cnn.com/2010/05/19/news/economy/naked_short_selling_wtf/index.htm

Let us quickly recap.

Naked short selling is when a broker sells 'troubled' shares, which they don't own, with intention of buying them back when the price drops.

It is in the brokers interest to sell a share which they know will lose value (charming!).

You should collaborate and clarify these concepts in the comment section below.