Task 2: Options / derivatives

In this next task we will explore what an option is.

Now there are many sites explaining share options.

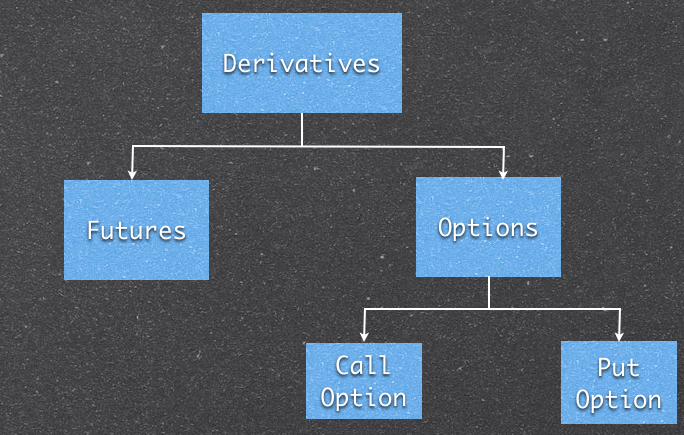

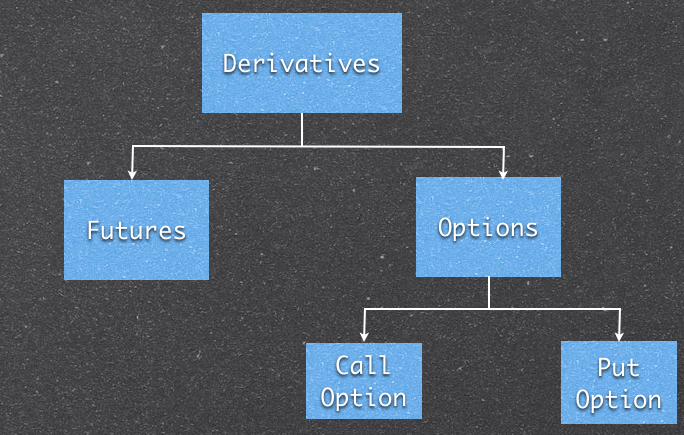

Derivatives are seen as complex financial instruments.

Before we start I want us to look at the procedure for placing a bet in a betting shop.

You can go into any betting office and wager a bet.

You fill out the betting slip. Pay a fee (the wager) and the contract is made.

Now the bet will be settled, when the event we are gambling on is over.

A couple of things to note.

The wager is paid at the time of making the bet and there is no further risk involved to the punter.

The book-maker will change the odds depending on the proportion of the bets placed on each candidate.

The book-maker will make money regardless of who is elected; by ensuring that the total of the odds is less than 100 %

The book-maker is acting as a broker between all the punters (some punters will win and some will lose).

Okay let us have a look at a financial instrument called an share option,

and see if there are any similarities to our betting scenario.

Firstly

The bookmaker is like the seller of the option.

The punter is like the buyer.

The broker is like a referee-matchmaker.

100 shares is known as a contract.

The settling price is known as the strikeprice.

Note that all options have an expiry date.

The premium is a fee given to the seller, who writes the contract. The seller gets the fee at the time the contract is written.

The settling up does not happen until the contract expires.

Note that there will probably be brokerage fees. Now this leads on to most important part of this whole option thingy.

The broker is just that; a broker.

The person writing the contract (which is not the broker) is called the seller (not as in call or put), as in, they WILL have to SETTLE the contract.

The buyer is holding the OPTION (buyer) can choose to exercise the option, but they do not have to. The buyer's total risk is basically their non refundable premium.

It is important to understand the difference between the buyer (punter) as in holding the option; and the writer as in selling or writing the option.

Okay let us have a look at an example:

The busiest options contract on Facebook was June $30 strike puts, with more than 18,241 contracts on the tape at an average price of $1.45 per contract, according to Trade Alert...

See the full article here:

http://www.reuters.com/article/2012/05/29/us-facebook-options-idUSBRE84S15520120529

Okay so we are talking big numbers here.

remember that a contract is 100 shares. Remember that With 18241 contracts at 1.45 dollars; we need to multiply 1.45 by 100 which is a premium of 145 dollars per contract (non refundable).

The PUT means the person holding the option has the option to sell the shares at 30 dollars (strike price) by some set day in June.

The person who writes the contract will have to buy them at the strike price (even if the price is a lot lower than 30 dollars).

You should collaborate and clarify these concepts in the comment section below.

And remember; caveat emptor!

Now there are many sites explaining share options.

Derivatives are seen as complex financial instruments.

Before we start I want us to look at the procedure for placing a bet in a betting shop.

You can go into any betting office and wager a bet.

You fill out the betting slip. Pay a fee (the wager) and the contract is made.

Now the bet will be settled, when the event we are gambling on is over.

A couple of things to note.

The wager is paid at the time of making the bet and there is no further risk involved to the punter.

The book-maker will change the odds depending on the proportion of the bets placed on each candidate.

The book-maker will make money regardless of who is elected; by ensuring that the total of the odds is less than 100 %

The book-maker is acting as a broker between all the punters (some punters will win and some will lose).

Okay let us have a look at a financial instrument called an share option,

and see if there are any similarities to our betting scenario.

Firstly

The bookmaker is like the seller of the option.

The punter is like the buyer.

The broker is like a referee-matchmaker.

100 shares is known as a contract.

The settling price is known as the strikeprice.

Note that all options have an expiry date.

The premium is a fee given to the seller, who writes the contract. The seller gets the fee at the time the contract is written.

The settling up does not happen until the contract expires.

Note that there will probably be brokerage fees. Now this leads on to most important part of this whole option thingy.

The broker is just that; a broker.

The person writing the contract (which is not the broker) is called the seller (not as in call or put), as in, they WILL have to SETTLE the contract.

The buyer is holding the OPTION (buyer) can choose to exercise the option, but they do not have to. The buyer's total risk is basically their non refundable premium.

It is important to understand the difference between the buyer (punter) as in holding the option; and the writer as in selling or writing the option.

Okay let us have a look at an example:

The busiest options contract on Facebook was June $30 strike puts, with more than 18,241 contracts on the tape at an average price of $1.45 per contract, according to Trade Alert...

See the full article here:

http://www.reuters.com/article/2012/05/29/us-facebook-options-idUSBRE84S15520120529

Okay so we are talking big numbers here.

remember that a contract is 100 shares. Remember that With 18241 contracts at 1.45 dollars; we need to multiply 1.45 by 100 which is a premium of 145 dollars per contract (non refundable).

The PUT means the person holding the option has the option to sell the shares at 30 dollars (strike price) by some set day in June.

The person who writes the contract will have to buy them at the strike price (even if the price is a lot lower than 30 dollars).

You should collaborate and clarify these concepts in the comment section below.

And remember; caveat emptor!